1. The Future of Microfinance: A few weeks ago I linked to a curious piece about the future of Indian microfinance, that seemed to be praising the swallowing of MFIs by traditional banks and justifying the extinction of MFIs that tried to go it alone. Dan Rozas wrote to point out some of the subtext: The pattern in India is similar to other countries, with the largest MFIs turning into banks. And while there are mergers and acquisitions, it is still largely the same organizations serving poor customers, "only now they're called banks." This week Barbara Magnoni tweeted from the Foromic conference that "microfinance is stale" so I asked her what she thought was next. Her response: "[B]ig MFIs win, digitize processes, poor too expensive to reach. Poor go back to cash/informal markets/ and consumer loans.YAY?:("

Between the two comments, I feel like the future of microfinance is already here, right here in the USA! Per Dan's note, the transition in India and elsewhere sounds a lot like the history of banking in the United States, right up through credit unions. And per Barbara's note, the next step is pulling back from poorer customers because they are more expensive to serve. So you end up with a system where even an institutional form whose original reason for being was to serve the excluded and put "clients at the center" (to borrow a phrase) has, aside from exceptional organizations, left the poorest behind. The global microfinance movement, I think, needs to spend a lot more time looking at the financial services landscape in the United States, because that is where, absent some major investment, are headed: nearly ubiquitous financial services, but very little quality available to lower-income customers, with plenty of predatory or just indifferent-to-the-effects-on-poor-customers actors ready to fill the gaps. I guess you could say that's the negative way of making the "Case for Social Investment in Microcredit".

To keep things from going too dark right off the bat, here's the story of how BRAC's MFIs in Liberia and Sierra Leone managed the Ebola crisis and it's aftermath (blog summary). And a shout-out to the Global Delivery Initiative for writing up stories like this in sufficient detail to be operationally useful.

OK, that's enough optimism for me. You might be skeptical of my take on where microfinance is headed. So let me present this piece from Matthew Soursourian over at CGAP on what can happen when we push consumers toward digital merchant payments, drawing parallels to the US experience.

2. The Future of Digital Finance (and of us all): That last piece could just as easily have fit here, so to encourage you to read it, let me just say again: the future of digital finance is already here, and contrary to popular opinion, it's in operation in the United States.

Still not buying it? Here's another CGAP piece drawing on the US experience: "How Developing Countries Can Prevent Their Own Equifax Breach." The encouraging thing is that this possibility is being considered; the discouraging thing is that David Medine is probably wrong: developing countries can't prevent their own breaches. At least there is no evidence so far that institutions are learning from examples like this, given how pedestrian the causes of such breaches are.

At a more macro level, Tyler Cowen and Matt Levine (a dreamteam if there ever was one) discuss where technology is taking finance. Pay special attention to the section in the middle where they discuss whether technology ultimately increases or decreases access to credit. While they don't mention it specifically, this is the big question mark about Lenddo and EFL, and their like, that I mentioned: while the algorithms will rescue lots of people who are good credit risks but can't prove it conventionally, they will also likely simultaneously lock bad credit risks out of the system permanently.

Speaking of being locked out, here are Charles Kenny and Cordelia Kenny reporting on a forum at CGD on women being locked out of FinTech companies and how that affects what services are being developed and who is served.

3. The Future of Our Algorithmic Overlords: One domain where the US is not the future is massive state infrastructure for identification and tracking. There the future is India (and China, but today we're talking about India after talking about China for the last several weeks). The best case scenario is that Aadhaar becomes a "societal platform" for delivering services much more efficiently and effectively. And there's evidence that it does. The worst case scenario is that Aadhaar is an insecure store of personal data that the state can nevertheless (or perhaps especially) use as a tool of control and coercion. And there's evidence of that too.

4. The Future of Household Finance: OK, this may be the only single link entry in the faiV in months, but I can't let this opportunity to bang on one of my pet drums pass by. In this edition of Matt Levine's newsletter he talks about evidence on the value of Morningstar's ratings of mutual funds (as usual you have to scroll way down to get to this section). Aside from a useful discussion of confounders in the data, he points out that Morningstar's ratings are worse predictors of future performance than some of the individual data points that make up the rating. In other words, Morningstar's ratings are negative information.

What does this have to do with household finance? Well, we're in a world where we broadly expect households to be able to compare financial services and make good choices about optimal products. But even the experts in stable industries with decades of detailed data produce ratings that are worse than useless. We should expect the future of household finance is lots of services to "help" households make financial decisions using algorithms and data, and that those ratings are going to be wrong.

5. The Future of Small Firms, Authoritarian Countries, and School Children: It wouldn't be the faiV if I didn't stretch the metaphor beyond all recognition at some point. Here's new work from David McKenzie on small firm death in developing countries. Remind me to produce some harangues about subsistence retail in the near future. Here's a newish paper on democratization that suggests that the transition from authoritarianism to democracy is almost always the result of mistakes, rationalized in hindsight. I suppose that's hopeful--we don't need authoritarian leaders to have a change of heart, but can expect that some number of them are just going to screw up and the results will be positive. And finally, the future of schoolchildren who are hungry is pretty easy to predict. So why aren't we doing more to feed them?

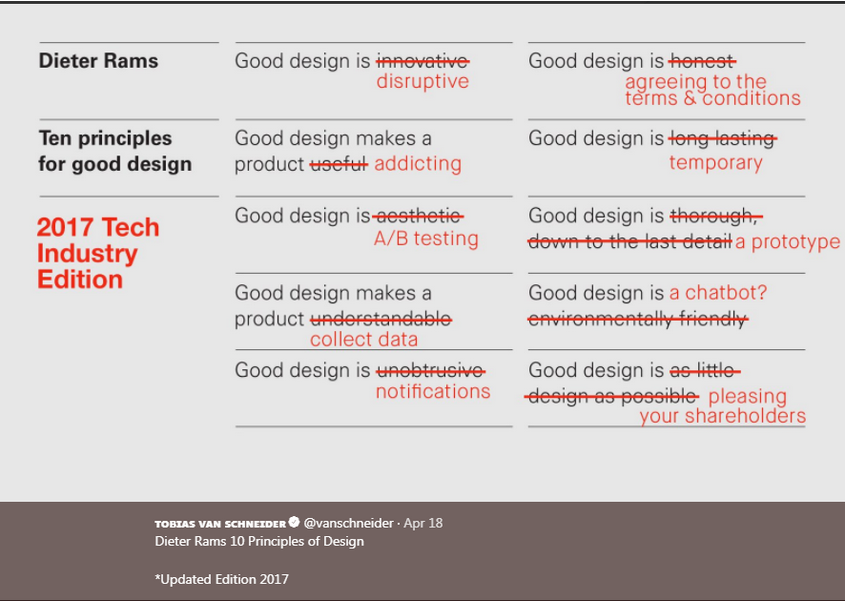

What good design really means in today's FinTech world. Via Tobias Van Schneider.